The Future of Money: How Central Bank Digital Currencies Could Reshape Finance

CBDCs are poised to revolutionize the future of money and finance.Imagine a world where you can instantly send money across borders without hefty fees, where your digital wallet is directly linked to the central bank, and where financial inclusion is the norm rather than the exception. This isn't a far-off sci-fi scenario – it's the potential future that Central Bank Digital Currencies (CBDCs) are promising to usher in.

As a finance professional who's been closely watching the evolution of money, I can't help but be fascinated by the emergence of CBDCs. These digital forms of a country's fiat currency, issued and regulated by the national central bank, are gaining traction globally and could fundamentally alter our financial landscape[1].

What Are Central Bank Digital Currencies?

At their core, CBDCs are the digital equivalent of cash. Unlike cryptocurrencies such as Bitcoin, which operate independently of governmental oversight, CBDCs are fully backed by the central bank and hold the same value as their physical counterparts[4]. Think of them as digital dollar bills or euro notes, but with enhanced features and capabilities.

The Drive Behind Digital Currencies

So why are central banks worldwide exploring CBDCs? The motivations are multifaceted:

- Maintaining monetary sovereignty: As private cryptocurrencies gain popularity, central banks are keen to retain control over their monetary systems[1].

- Improving financial inclusion: CBDCs could provide banking services to the unbanked population, potentially revolutionizing access to finance in developing countries[4].

- Enhancing payment efficiency: Digital currencies could make transactions faster and cheaper, especially for cross-border payments[4].

- Better monetary policy implementation: CBDCs could offer central banks more direct and efficient tools for implementing monetary policy[1].

The Current CBDC Landscape

While many countries are still in the research phase, some have already taken the plunge. China is leading the pack with its digital yuan, already being piloted in several cities[5]. The Bahamas has launched the Sand Dollar, while Nigeria introduced the eNaira in 2021[4]. Meanwhile, major economies like the U.S., EU, and UK are actively exploring CBDC options[1].

Potential Benefits of CBDCs

The introduction of CBDCs could bring numerous benefits:

- Faster, cheaper transactions: Imagine sending money to a friend in another country as easily as sending a text message, and at a fraction of the current cost.

- Reduced cash management costs: For central banks, the cost of printing, distributing, and managing physical cash could be significantly reduced[4].

- Enhanced financial tracking: CBDCs could help combat financial crimes by making transactions more traceable[4].

- Programmable money: Smart contracts could automate payments based on predefined conditions, opening up new possibilities in finance.

Challenges on the Horizon

However, the path to CBDC implementation is not without hurdles:

- Privacy concerns: The potential for increased financial surveillance raises significant privacy issues[4].

- Cybersecurity risks: As with any digital system, CBDCs would need robust protection against cyber threats.

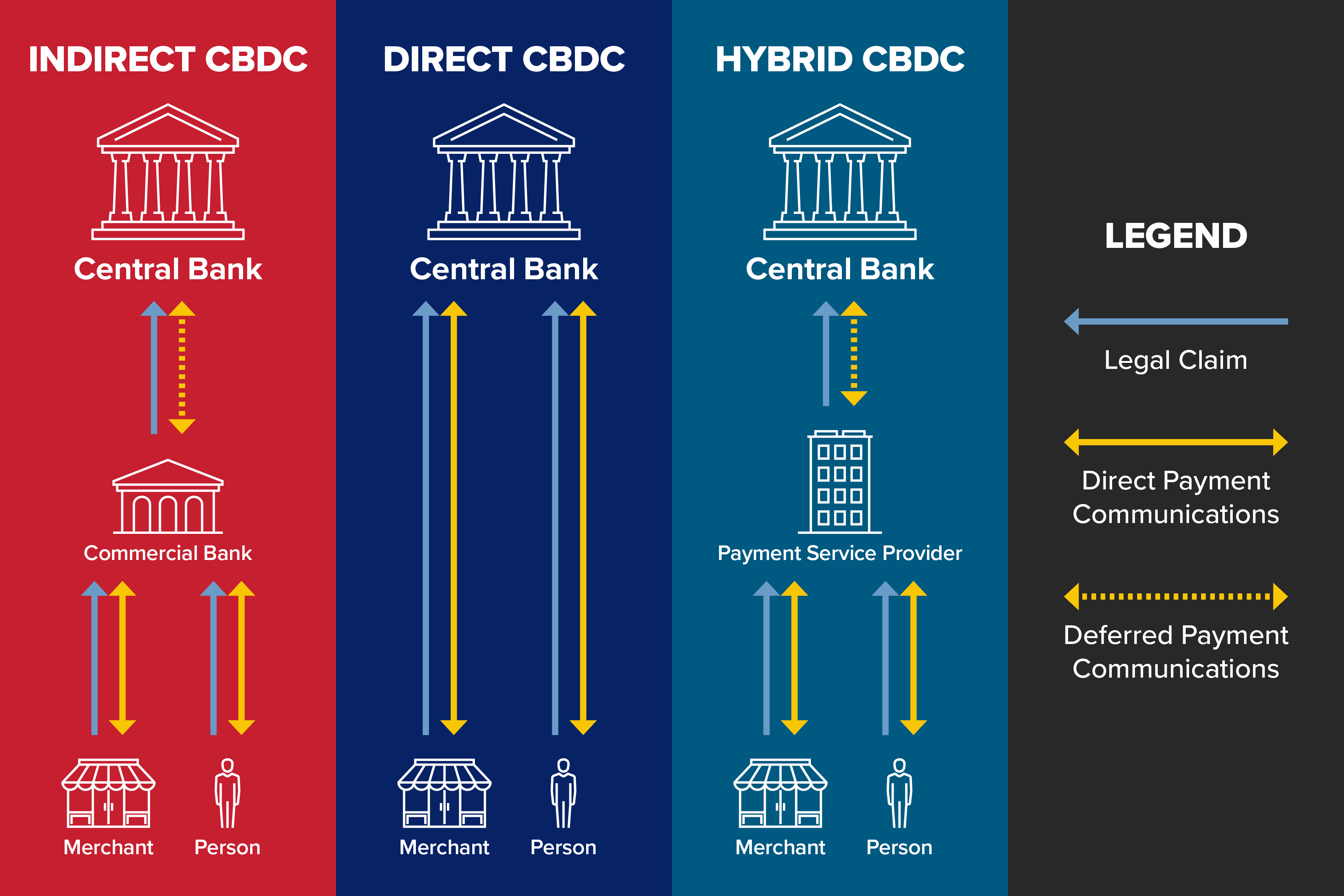

- Impact on commercial banks: CBDCs could potentially disrupt traditional banking models[1].

- Technological barriers: Ensuring widespread access and ease of use remains a challenge.

Reshaping Everyday Finance

If widely adopted, CBDCs could transform how we interact with money. Imagine your salary being instantly deposited as digital currency, or smart contracts automatically paying your bills. The line between physical and digital money could blur, potentially making cash obsolete in some societies.

Global Implications

The advent of CBDCs could reshape global finance. They might facilitate easier international trade, but could also intensify currency competition. Could we see a shift in global financial power dynamics? Only time will tell.

The Road Ahead

While widespread CBDC adoption isn't happening overnight, the momentum is building. I predict that within the next decade, we'll see several major economies launch their own CBDCs, with interoperability becoming a key focus.

As we stand on the brink of this potential financial revolution, one thing is clear: the future of money is digital, and CBDCs are likely to play a significant role in shaping it. Whether this new era of finance will fully deliver on its promises remains to be seen, but it's certainly an exciting time to be in the world of finance and monetary policy.

Sources

[1] IMF - Central Bank Digital Currencies: 4 Questions and Answers

[2] Migration Letters - Central Bank Digital Currencies: A Survey

[3] BIS - Central Bank Digital Currencies

[4] IMF Blog - Central Bank Digital Currencies: 4 Questions and Answers

[5] Investopedia - What Is a Central Bank Digital Currency (CBDC)?

[6] ResearchGate - Central Bank Digital Currencies: Agendas for Future Research

The Ultimate Guide to Mortgage Rates in 2024: What Every Homebuyer Should Know

Comments

No comments yet. Be the first to comment!

Leave a Comment